Oil and Gas Industry

Oil and Gas Industry

Are you navigating the complexities of family law and in need of expert support in Paisley? The intricacies of family legal issues can often feel overwhelming,

Is your home in Glasgow struggling to keep up with the chill of winter? A new combi boiler might be the perfect solution to warm your

Is advancing in the plastering industry not just a possibility but a necessity for aspiring craftsmen? For those aiming to elevate their expertise, the Plastering Level

Is pain dictating the rhythm of your life, or could physiotherapy be the key to reclaiming control? Beyond mere rehabilitation, physiotherapy transforms lives by enhancing mobility

Fuel Fuels like gasoline, kerosene and diesel oil help drive the cars, trucks and trains that make the modern world go around. They also power many

The FLIPR system is an industry standard for high-throughput kinetic screening of GPCRs and ion channels linked to Ca2+. The instrument uses a cooled CCD camera

Air Pollution Air pollution is a group of substances in the atmosphere that can harm the health of people, animals, and plants. It can also damage

Overhead cranes are heavy-duty machines that are used to transport large objects from one location to another. They are designed to suit a specific loading application,

Learn How an Air Conditioner Works by reading this article. Learn about the Copper pipe, Evaporator coil, and Refrigerant. It will make your life a lot

The benefits of boiler service go beyond the cost. Most modern combi boilers are efficient and more affordable than ever however that does not make them

The exploration and production activities are the heart of the oil industry, the sector in which the most advanced technologies are developed and used and from which the greatest profits come, to compensate for the mining risk. In addition to the technical risk, consisting in the eventuality that the identified geological structure does not contain hydrocarbons or contains them in non-commercial quantities, there is the economic one, defined by the possibility that at the time of entry into production, years after the discovery, the price of the crude oil makes the new field unprofitable.

Increasing the efficiency of vehicles could therefore reduce their consumption, pollution and emissions.

The discovery of a new field, the definition of its production capacity and its preparation for production require significant investments and long times, during which the price of oil can change several times shadow prices, which are based on forecasts for the future and which may be higher or lower than the real price. The actual research costs, due to the risk margin that characterizes them, must be covered with own capital and are not amortized. After the discovery, projects to develop the field, put it into production and reach the market can be carried out with loan capital, and this has given rise to important examples of project financing.

In the 1980s, the cost of producing a barrel of crude oil was close to $20. From then on, a period of cost reduction began thanks to the introduction of new technologies, such as the drilling of horizontal wells; these in fact cross the entire area of the reservoir and not only its thickness (each of them produces as many vertical wells). The value of production is also affected by the taxes due to producing countries, which have risen in percentage (from 36 % in 2004 to over 42 % of2010 ) and in absolute value (from approximately $13 in 2004 to $34 in 2010).

Technological progress is based on the need to reduce costs and increase production, and also on the need to work in relatively marginal areas compared to large producing areas. Since large international private companies are not always welcome in producing countries, which prefer to operate through their national companies, they have to work in available areas, which are not necessarily the best.

The functioning of the mining industry is broadly the same as it once was; however, today a reservoir can be identified with great precision, in three and even in four dimensions (ie by adding the time dimension), with a reduction in costs and, on the other hand, an increase in the complexity of the system.

Finally, the profitability of a field is defined by the quality of the crude oil, which is not a homogeneous product: each field offers, in fact, a different crude. There are various classifications: the simplest and most important are the one that distinguishes between light and heavy crude oils and the one that divides sulphurous crudes (called acids) from sweets.

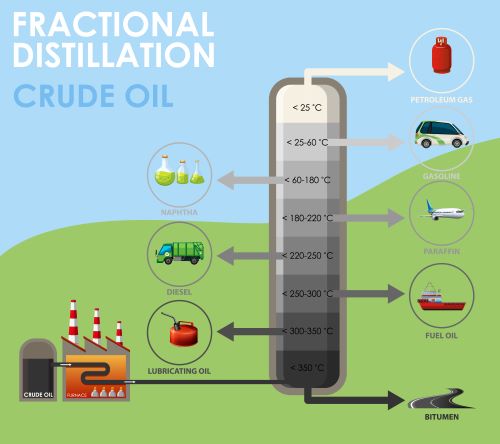

Sweet and light crude oils are worth more, because in the refinery they produce a high percentage of light substances, i.e. LPG (Liquefied Petroleum Gas), virgin diesel and gasoline.

Possible further developments in energy efficiency are in themselves a factor in the longer life of oil.

Crude oil fields almost always also produce a certain amount of associated gas, consisting of a mixture of various gases: up to 70 % methane, and then different gases, mainly ethane, propane and butane. Gases are separated, starting with methane, which is an excellent fuel and separates easily from oil and other gases, and continuing with the latter, which require more complex operations.

Ethane is the best raw material for making ethylene in a cracker petrochemical. Propane and butane are also good petrochemical fillers, but being easily liquefiable, unlike methane and ethane, they are also sold for domestic thermal use, in cylinders or in urban networks. In the United States, or Saudi Arabia, the total volume of associated gas produced together with crude oil represents about 10 % of the volume of crude oil.

The recovery of these gases made it possible to abandon the use of flaring associated gases, which caused serious damage to the environment and wasted an important resource. In many areas of the world there are also deposits of dry gas, that is methane with little presence of liquid products, such as those of the Po Valley.

Once the field has been discovered and put into production, increasing its production requires almost zero additional costs: the marginal cost of producing crude oil is almost zero, so companies tend to increase production. This propensity favors the alternation between periods of intense competition, followed by the establishment of a production control, such as the proration adopted in the United States in the 1930s, or the concentration of activity in large companies, capable of grading production and forging the market in tight oligopoly. The crude oil market

The price of crude oil was initially derived, for the purposes of calculating royalties (the sums owed to the royal house or the state as their part of the crude produced, commensurate with the company’s profits from the field), from the price offered in the United States (a high cost area) from large refineries to independent producers. With the great oil shock of 1973, the OPEC (Organization of the Petroleum Exporting Countries, which includes, among other things, all the main producing countries of the Middle East except Oman) decided to claim both the production volume and the price, to keep the former as low as possible and the latter as high, thus increasing the share of the producing country. In 1985 the price plummeted due to Saudi Arabia’s decision to tie its crude to Brent in the North Sea. Previously, during the formation period of the crude oil market, the development of the spot market (through which individual vessels were sold on the spot, ie where they were, and then diverted to this or that buyer) had allowed producing countries to assess whether the OPEC price actually responded to the current relationship between supply and demand.

Therefore oil companies, large and small, no longer manage the crude oil market, and are price takers, no longer price makers. The same is true of OPEC, which nevertheless controls the volume of production. For the companies, part of their profound change is embodied in the fact that they have abandoned the concept of integration, reduced their presence in less decisive sectors, such as transport and refining, and also as regards the management of crude oil. market dependent.

Companies have also changed in their relationship with their shareholders. They fear the takeovers of financial groups, and to avoid this eventuality they pay rather high dividends and buy back their own shares to keep their value high. A series of mergers has reduced the number of large companies by increasing their size, a goal pursued on the one hand to reduce costs and on the other to make possible takeovers more expensive.

Alongside the majors, there are state-owned companies (called NOCs, National Oil Companies ) that produce on their own in the countries where oil is nationalized.